stock options tax calculator usa

60 of the gain or loss is taxed at the long-term capital tax rates. 4 HI hospital insurance or Medicare is 145 on all earned income.

Capital Gains Tax Calculator 2022 Casaplorer

The wage base is 142800 in 2021 and 147000 in 2022.

. See your gain taxes due and net proceeds with this calculator. Ordinary income tax and capital gains tax. Ad Enter Your Tax Information.

What will my options be worth if my companys stock price changes. Find the best spreads and short options Our Option Finder tool. Refer to Publication 525 for specific details on the type of stock option as well as rules for when income is reported and how income is reported for income tax purposes.

There are two types of taxes you need to keep in mind when exercising options. On the date of exercise the fair market value of the stock was 25 per share which is. New Hampshire doesnt tax income but does tax dividends and interest.

Content updated daily for stock options tax calculator. Poor Mans Covered Call calculator addedPMCC Calculator. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share.

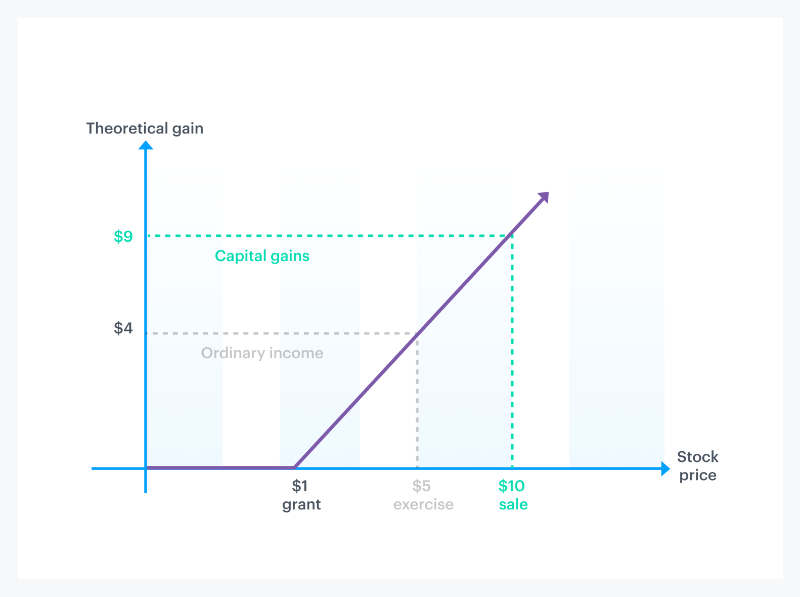

In our continuing example your theoretical gain is. 40 of the gain or loss is taxed at the short-term capital tax. The Stock Option Plan specifies the employees or class of employees eligible to receive options.

NSO Tax Occasion 1 - At Exercise. You can find your federal tax rate here. Plug In To The Worlds Largest On-Demand Domestic Accounting Workforce.

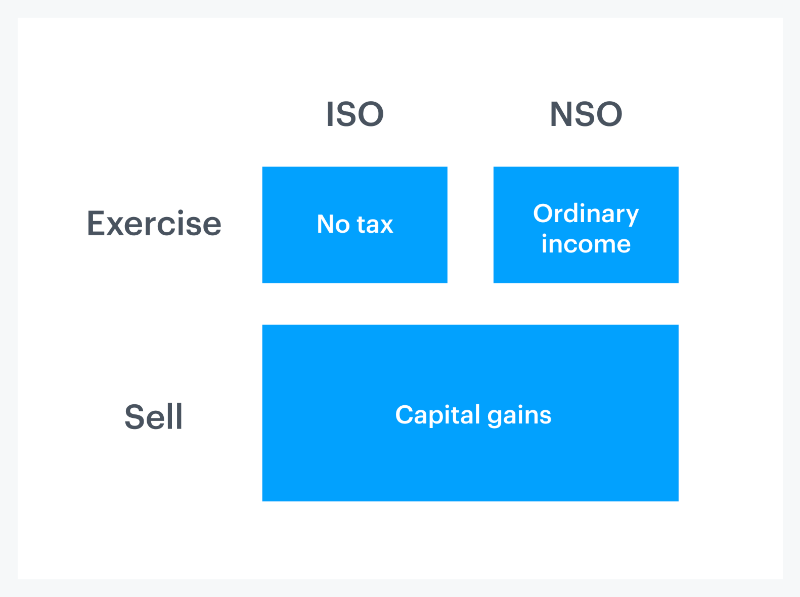

The Stock Option Plan specifies the total number of shares in the option pool. Calculate my AMT Reduce my AMT - ISO Planner. Holders of non-qualified stock options NSOs are subject to tax at exercise if the fair market value of the stock is higher than the exercise price spread.

Lets say you got a grant price of 20 per share but when you exercise your. Ad Fidelity Has the Tools Education Experience To Enhance Your Business. Stock Option Calculator Canadian Receiving options for your companys stock can be an incredible benefit.

On this page is a Restricted Stock Unit Projection calculator or RSU calculator. You may be able to unlock favorable long-term capital gains tax rates a top rate of 20 if you hold ISOs for at least two years from the date the options are granted and longer. Maximize your stock compensation gains and prevent.

Exercising your non-qualified stock options triggers a tax. Section 1256 options are always taxed as follows. If you leave a company and.

See What Credits and Deductions Apply to You. Ad Visualize complex data with FT Options Mosaic. Locate current stock prices by entering the ticker symbol.

RSU Calculator Projecting Your Grants Future Value. Ad Fidelity Has the Tools Education Experience To Enhance Your Business. Ad This is the newest place to search delivering top results from across the web.

The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high. This easy to use online alternative minimum tax AMT calculator estimates your tax liability after exercising Incentive Stock Options ISO for. The results provided are an.

Request a free trial today. You paid 10 per share the exercise price which is reported in box 3 of Form 3921. Enter details of your most recent RSU grant your.

Even after a few years of moderate growth stock options can produce a. Non Qualified Stock Options Calculator. Cash Secured Put calculator addedCSP Calculator.

Taxes for Non-Qualified Stock Options. Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in. Your payroll taxes on gains from.

Request a Free Trial Today. Find Alpha and Manage Risk with Cboes FT Options Platform. Ad Taxfyle solves all of your tax needs by connecting you w a US-based licensed CPA pro.

How Stock Options Are Taxed Carta

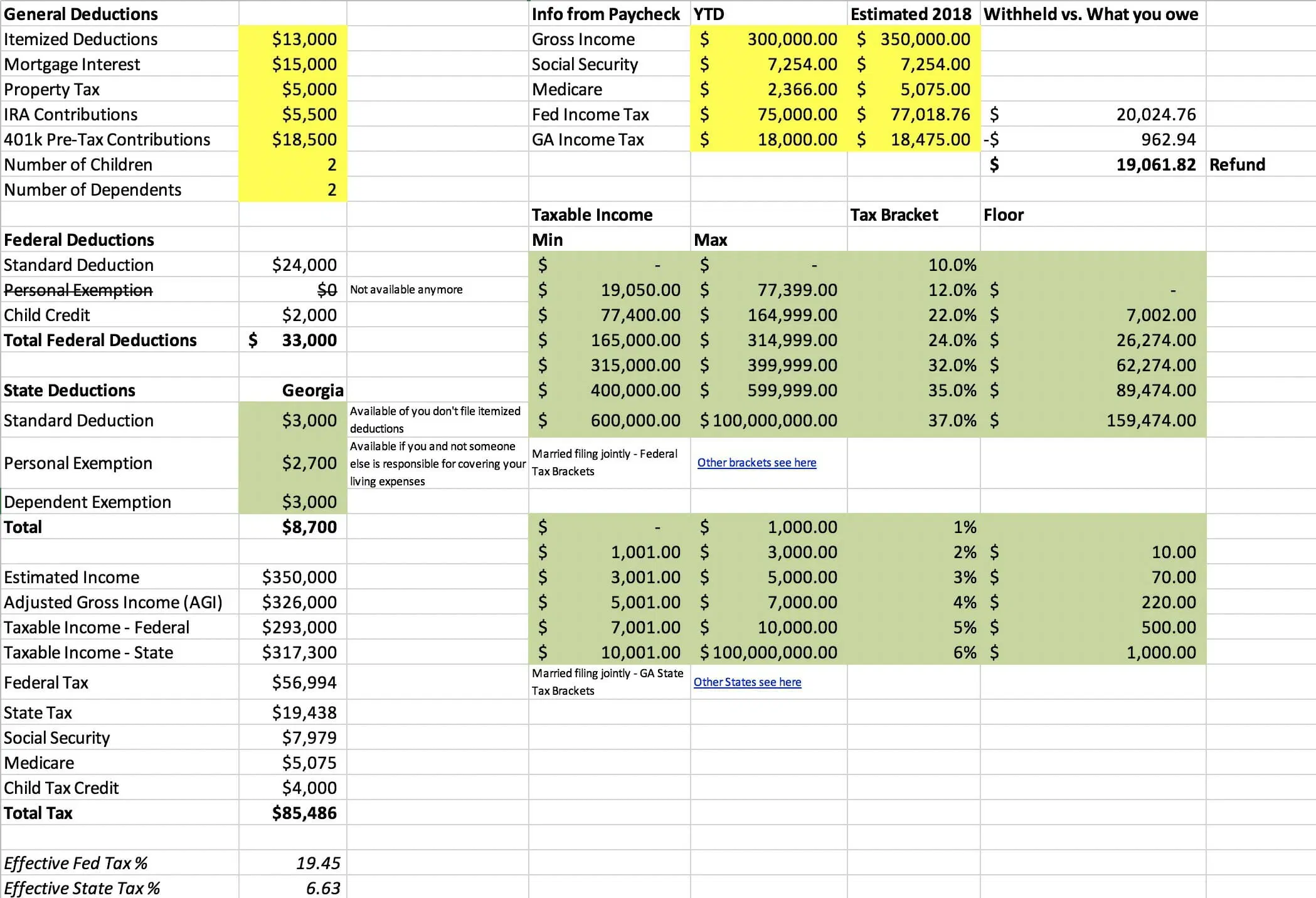

New Tax Calculator Shows Taxpayers Their Tax Bill Under Many Scenarios Tax Foundation

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

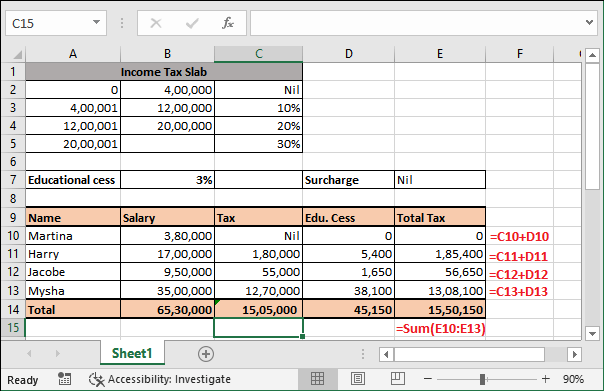

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

Quarterly Tax Calculator Calculate Estimated Taxes

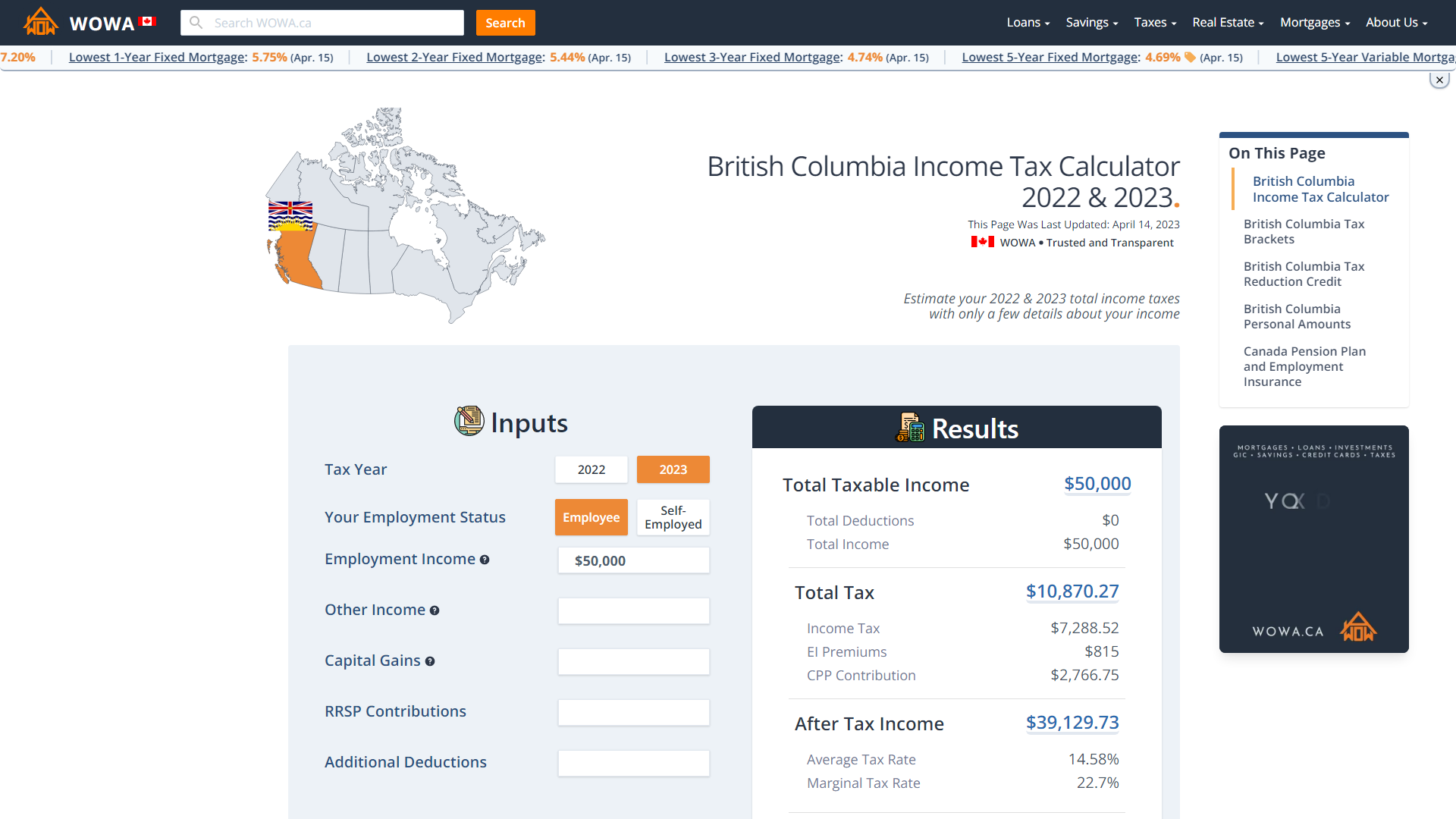

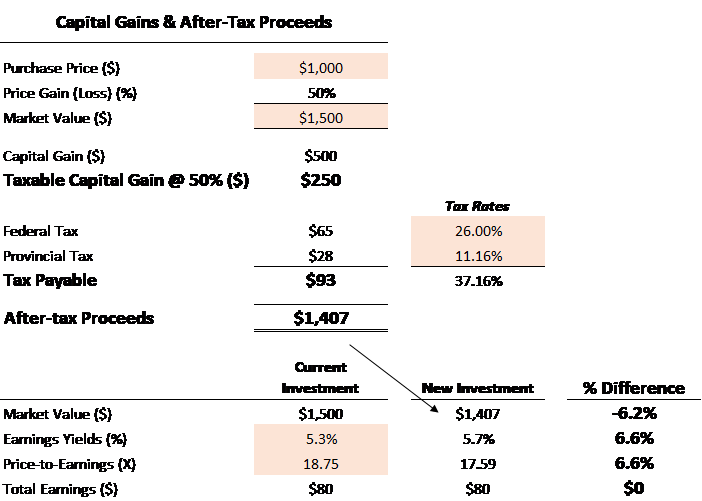

Bc Income Tax Calculator Wowa Ca

Tax Season With Wooden Alphabet Blocks Calculator Pen On 1040 Stock P Affiliate Wooden Alphab Wooden Alphabet Blocks Wooden Alphabet Alphabet Blocks

Income Tax Calculating Formula In Excel Javatpoint

Tax Time Blue Tinted Image Of Calculator And Figures On Paper Selective Focus Ad Tinted Image Calculator Tax Time Ad Tax Time Tax Calculator

Seller Mortgage Payoff Investing Stock Market

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

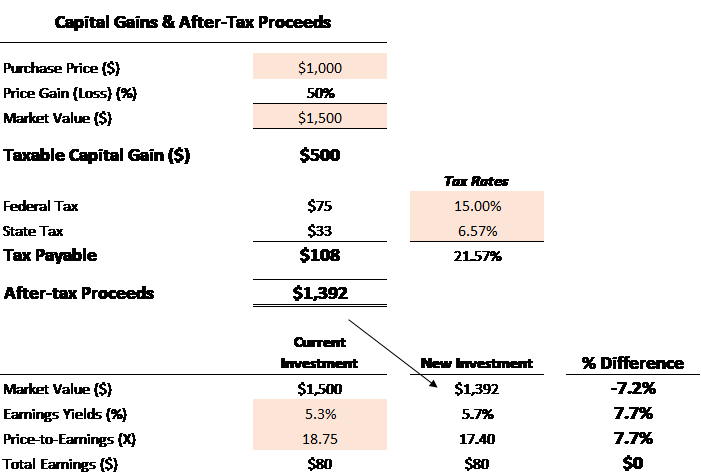

Capital Gains Tax Calculator For Relative Value Investing

Cpa For Freelancers And The Self Employed In Nyc Small Business Cpa Manhattan Cpa Self Employed Nyc Cpa William Income Tax Tax Services Income Tax Return

Capital Gains Tax Calculator For Relative Value Investing

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Net Worth Percentile Calculator United States And Average Net Worth Net United States